Flippitt PoS, the Multi-currency, Multi-chip, Terminal

Processes Trade, Crypto, & Digital Money at the Point of Sale

Merchants accept trade currency for real time secure transaction processing to your exchange.

Innovative transformations are reshaping how barter exchanges and their members transact, offering multiple options, greater convenience, security, and efficiency + new revenue streams.

In today’s fast-paced digital economy, legacy barter exchanges must consistently evolve to meet the demands of modern business. One of the most transformative developments in trade and cross-border payments is the integration of digital payments, particularly via digital trade currencies on blockchain.

The Challenges of Traditional Barter

Barter systems have been around for a centrry, allowing businesses and individuals to trade goods and services without using cash. However, traditional barter often faces key limitations:

Coincidence of wants: A seller must have something other members want.

Limited flexibility: Transactions often require negotiations requiring broker interaction or transaction management.

Tracking issues: Manual record-keeping when members don’t post their own transactions can lead to errors and inefficiencies.

These challenges can create friction for the member experience, reducing the speed and ease with which value is exchanged.

Digital Payments are a Game-Changer for Barter Exchanges

By introducing digital payments into barter networks, exchanges can eliminate many of the logistical headaches of traditional systems. Here’s how digital payments improve the member experience:

Increased Transaction Speed

Digital payments allow members to complete trades instantly, without the need to negotiate terms in real time or physically exchange goods. Members can accept payment in digital trade currency and fulfill the order on their own schedule.

Simplified Multilateral Trade

Digital trade currencies remove the need for direct, one-to-one barter. A member can sell a service to one party and use their earned digital credits to purchase from another, enabling multilateral trade, which dramatically increases network liquidity.

Improved Record-Keeping and Transparency

Every digital transaction is automatically recorded on blockchain, or in a system ledger. This gives members and exchange administrators real-time visibility into trade balances, transaction histories, and credit limits — improving transparency and reducing issues.

Better Matching of Supply and Demand

With digital payments, exchanges can use platforms and apps to match buyers and sellers quickly. Members can browse an online marketplace and pay a seller in trade credits, which settles immediately in real time, streamlining the user experience.

Increased Trust and Security

Digital payment platforms often include fraud protection, dispute resolution tools, and member verification — all of which build trust in the network and encourage more frequent participation.

The Power of Digital Trade Currency

Digital trade currency — the non-cash, credit-based medium of exchange used within a barter system — offers specific advantages when digitized:

Increased Trade Velocity

Because digital trade credits can be earned and spent flexibly, they keep the economy and trade velocity within the barter network moving. Members can spend earned credits without delay, which encourages reinvestment in the network.

Preserves Cash Flow

Using trade credits for business needs (marketing, printing, legal services, etc.) means members can conserve cash, and use it for critical expenses like rent, taxes, or payroll.

Increases Member Retention

When members derive tangible value from digital trade currency, they are more likely to remain active and loyal to the exchange. A well-designed system that facilitates frequent, easy trades keeps members engaged.

Scalability and Automation

Digital currencies can be easily integrated with mobile apps, web platforms, and reporting tools. This enables automated statements, recurring payments, and scalable growth as the member base increases.

Digital payments and digital trade currencies are not just conveniences — they are essential upgrades for modern barter exchanges. By reducing friction, increasing liquidity, and offering a more seamless and secure user experience, the latest enhancements in trade commerce software empowers members to get the most value from their participation.

For barter exchanges looking to stay competitive and expand, adopting digital payment infrastructure, trade commerce marketplaces, and innovative ideas sets an exchange up for success and differentiation from legacy “barter clubs.” It’s a strategic move that enhances both member satisfaction and broker productivity and profitability.

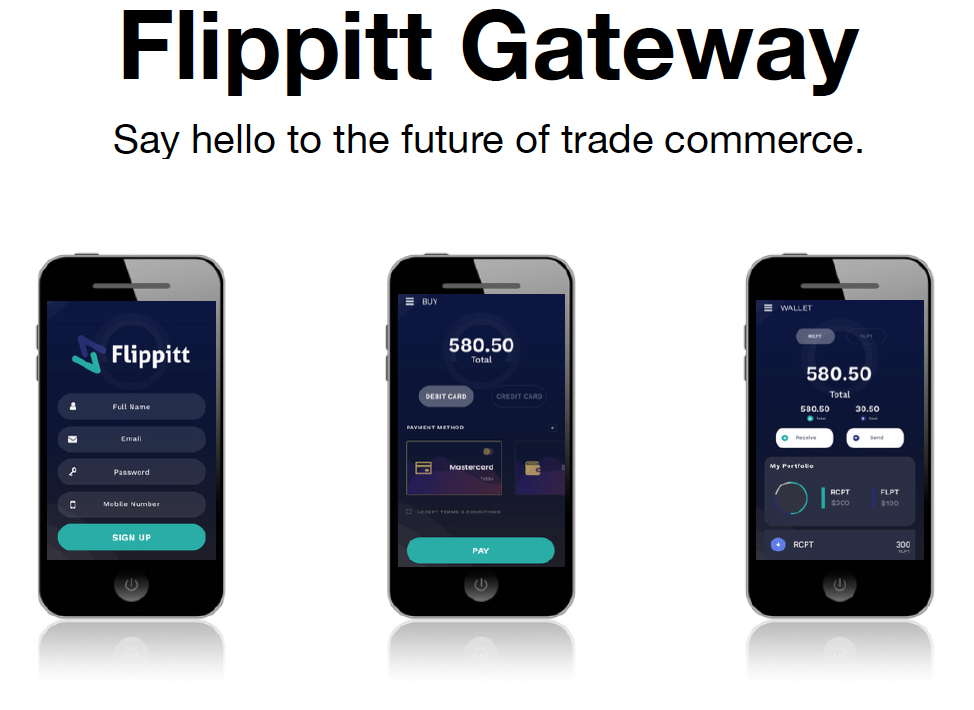

Powering the Next Generation of Barter with a Multi-Currency Payment Gateway

Grow your barter exchange by enabling digital trade payments in barter dollars, crypto, stablecoins, and asset-backed currencies — all within a closed-loop, enterprise-ready ecosystem.

Barter Exchanges Need a Payments Upgrade

Traditional barter exchanges are limited by their reliance on a single trade currency. To attract larger businesses — including hotels, restaurant groups, service providers, and enterprise clients — your exchange needs to offer:

- Flexible, secure payment processing

- Enterprise-grade ease of use

- Broader spendability and liquidity options

The Flippitt closed-loop multi-currency payment gateway provides your exchange all of that and more.

Key Benefits for Your Exchange

- Attract larger, high-volume members

- Offer large businesses the ability to accept and spend not just barter dollars, but also Stablecoins, major cryptocurrencies and asset backed currencies, such as silver and gold

- Digital trade credits

increase transaction volume & velocity,

enable seamless multilateral trade by removing friction, and expanding payment flexibility. - More ways to pay = more trades completed = higher member engagement.

- Expand Trade Utility for Members

Help your members spend their earned trade credit on real operational costs such as hotel accommodations, restaurant supplies, travel, media, services, and more.

- High-value spend options make your exchange more attractive and sticky.

- Stay Secure & Compliant

- Built-in tools for ledger management and reporting

- Secure, real-time settlements

- Smart contracts and conditional trade execution

- Audit trails and tax-friendly statements

One Platform. Endless Trade Possibilities.

This is more than a payment solution — it’s a barter exchange transformation engine.

- Easy API integration

- White-labeled for your brand

- Supports multi-location businesses

- Unlocks inter-exchange trading potential

Ready to Future-Proof Your Barter Exchange? Empower your platform to do more? Modernize how members trade? Support multi-currency transactions Drive growth and revenue at scale? Make the Shift?

Connect to explore technical setup, member education & adoption, and monetization models for digital payment layers.